Concept of Proportional, Progressive, Regressive, and Digressive Taxes

A. Proportional Tax

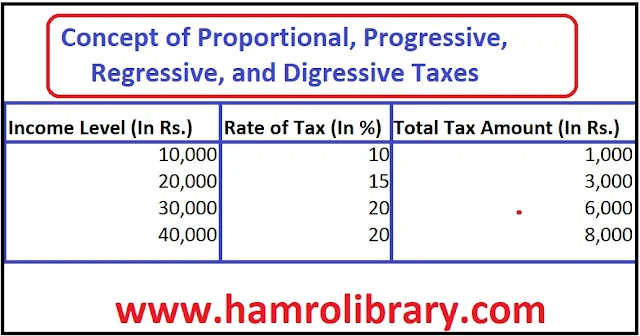

If the rate of tax remains the same at every level of income and wealth, it is called proportional tax. The amount of tax paid by different persons may be different but the rate of tax does not change. A flat rate is imposed on the rich and the poor. In this system, a person who earns greater income and wealth should pay more amount of tax but there is no discrimination in the ratio of tax.A proportional tax is very simple because the rate of tax is the same for the rich and the poor. The tax paid by the person of a low level of income causes a greater sacrifice of utility than the rich. According to the law of diminishing marginal utility, the marginal utility of money income goes on decreasing with the rising level of income. In this situation, when a rich person pays the same rate of tax, his/her sacrifice will be less than the poor. An example of a progressive tax is given in the following table:

|

Income Level (In Rs.) |

Rate of Tax (In %) |

Total Tax Amount (In Rs.) |

|

10,000 |

10 |

1,000 |

|

20,000 |

10 |

2,000 |

|

30,000 |

10 |

3,000 |

|

40,000 |

10 |

4,000 |

In the above figure, the tax rate is measured along Y-axis and the income is measured along the X-axis. The line PQ shows the same rate of tax on all the income groups. The tax rate is 10% on all the income groups. It indicates that the tax rate does not change even if there is a change in the income of the taxpayers under the proportional tax system.

B. Progressive Tax

A progressive tax is a system in which the rate of tax increases with the rise in the level of income and wealth. The tax rate increases equal to or more than proportionate to the increase in the income level. In other words, the rate of tax rises when the income rises but the proportion of the rate of tax is equal to or higher than the proportion of the increase in the income level.According to Prof. Taylor, "As taxable incomes rise under progressive taxation, the effective rate of tax rises for marginal increments of income subject to higher tax rates".

A person who earns greater income should pay a higher rate of tax. In this system, the distribution of tax is made in an equitable manner. Since the marginal utility of money diminishes with the increasing level of income, the rich people have a greater capacity to pay the tax than the poor. The sacrifice of utility made from the payment of tax will be equal when the rich people pay a higher rate of tax than the poor.

Theoretically, the system of a progressive tax is quite reasonable but in practice, it is difficult to decide the rate of progression. There is no scientific measurement to achieve the equality of sacrifice.

However, this system of tax is flexible, economical, and more income-earning to the government. It is based on the principle of ability to pay and it helps to reduce the inequality of income of the society. But the tax authority should consider that the higher rate of tax may cause an adverse effect on saving and investment. An example of a progressive tax is given in the following table:

In the above figure, the tax rate is measured along Y-axis and the income is measured along the X-axis. The upward sloping curve PQ shows a progressive tax system. As the number of total income increases from Rs. 10,000 to Rs. 20,000, the tax rate also increases from 5 percent to 15 percent. In this way, when the income increases to the higher levels, the tax rate also increases in the same direction. It indicates that the higher the income, the higher the tax, and the lower the income, the lower the tax. ax

|

Income

Level (In Rs.) |

Rate

of Tax (In %) |

Total

Tax Amount (In Rs.) |

|

10,000 |

5 |

500 |

|

20,000 |

15 |

3,000 |

|

30,000 |

25 |

7,500 |

|

40,000 |

35 |

14,000 |

In the above figure, the tax rate is measured along Y-axis and the income is measured along the X-axis. The upward sloping curve PQ shows a progressive tax system. As the number of total income increases from Rs. 10,000 to Rs. 20,000, the tax rate also increases from 5 percent to 15 percent. In this way, when the income increases to the higher levels, the tax rate also increases in the same direction. It indicates that the higher the income, the higher the tax, and the lower the income, the lower the tax. ax

C. Regressive Tax

A regressive tax is a system in which the rate of tax decreases with the rise in the level of income. The lower rate of tax is charged on the higher level of income. It means the poor should pay a higher rate of tax in comparison to the rich. In this system, the government can collect more revenue because the number of poor is more in the society who pay the tax at a higher rate.But this system is unjust and inequitable. The sacrifice of utility made by the poor is higher, which causes a greater burden on them. Therefore, the system of regressive taxation is not practicable and appropriate in a developing country. This type of tax system rarely exists in real life. An example of a regressive tax is shown in the following table:

In the above figure 7.3, the tax rate is measured along Y-axis and the income is measured along the X-axis. PQ line shows the regressive tax rate. When the total income is 10,000, the tax rate is 10 percent. As the income rises from 10,000 to 20,000, the tax rate decreases to 9 percent. Further increase in income brings a lesser tax rate. It indicates that the lower the income, the higher the tax rate, and the higher the income, the lower the tax rate.

|

Income

Level (In Rs.) |

Rate

of Tax (In %) |

Total

Tax Amount (In Rs.) |

|

10,000 |

10 |

1,000 |

|

20,000 |

9 |

1,800 |

|

30,000 |

8 |

2,400 |

|

40,000 |

7 |

2,800 |

In the above figure 7.3, the tax rate is measured along Y-axis and the income is measured along the X-axis. PQ line shows the regressive tax rate. When the total income is 10,000, the tax rate is 10 percent. As the income rises from 10,000 to 20,000, the tax rate decreases to 9 percent. Further increase in income brings a lesser tax rate. It indicates that the lower the income, the higher the tax rate, and the higher the income, the lower the tax rate.

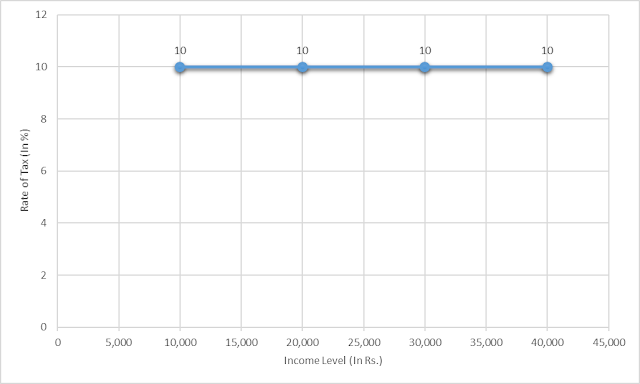

D. Digressive Tax

Digressive tax is a system in which the tax rate increases with the rise in income up to a certain limit but beyond that limit the tax rate becomes constant. Digressive tax may be called a mildly progressive tax. It is a milder form of progression which means that the larger incomes make a lower relative sacrifice than the smaller incomes. An example of digressive tax is shown in the following table:|

Income

Level (In Rs.) |

Rate of Tax

(In %) |

Total Tax

Amount (In Rs.) |

|

10,000 |

10 |

1,000 |

|

20,000 |

15 |

3,000 |

|

30,000 |

20 |

6,000 |

|

40,000 |

20 |

8,000 |

In the above figure, the PQ line shows the digressive rate of taxation. In the figure, the tax rate is measured along the Y-axis and the income is measured along the X-axis. As income increases from 10,000 to 20,000 and 20,000 to 30,000, the rate of tax also increases from 10 percent to 15 percent and 15 percent to 20 percent respectively. But beyond the income of 30,000, the rate of tax is the same for all the income groups. So, the tax curve PQ becomes horizontal after point A.

.jpeg)

0 Comments

If this article has helped you, please leave a comment.