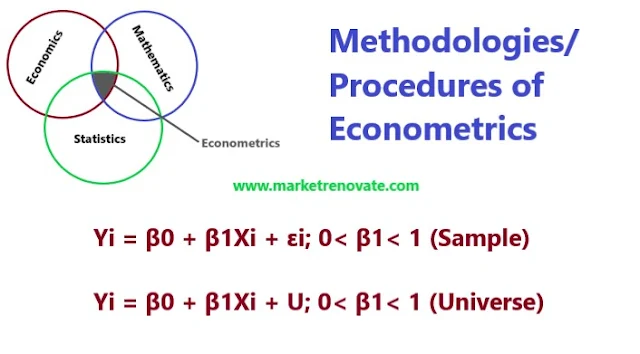

Procedures of Econometrics/ Methodologies of Econometrics

Econometrics is the study of economic data and the testing of economic theories using statistical and mathematical methods. To achieve this goal, econometricians employ a variety of methodologies at various stages, from theory and hypothesis formulation to policy application. In this blog post, we will go over some of the most commonly used econometric methodologies and examples of how these methodologies are used in practice.

1. Theory or Hypothesis Statement

Forming a theory or hypothesis is the first step in any econometric analysis. This process involves identifying a problem or question and developing a theoretical framework. A researcher, for example, may be interested in researching the relationship between education level and earnings. According to the theory or hypothesis, higher education levels lead to higher earnings.

Let’s say we want to test the hypothesis that higher levels of education lead to higher earnings. We might formulate the hypothesis as follows:

H0: Education level has no effect on earnings.

HA: Education level has a positive effect on earnings.

2. Specification of the Theory’s Mathematical Model

Following the formulation of the theory or hypothesis, the next step is to specify a mathematical model that can be used to test the theory. The mathematical model should include all relevant variables consistent with the theoretical framework. In the case of a relationship between education level and earnings, for example, the mathematical model could include education level as an independent variable and earnings as a dependent variable.

To specify the mathematical model, we might use the following equation:

Y = β0 + β1X + ε; 0< β1< 1

Where,

Y is earnings,

X is education level,

β0 is the intercept,

β1 is the slope coefficient for education level, and

ε is the error term.

3. Specification of the Theory’s Econometric Model

The econometric model statistically represents the mathematical model. It entails specifying the functional form of the mathematical model and estimating the model’s parameters. A linear regression model, for example, could be used to model the relationship between education level and earnings.

To estimate the econometric model, we would specify the functional form of the mathematical model, such as a linear regression model:

Yi = β0 + β1Xi + εi; 0< β1< 1 (Sample)

Yi = β0 + β1Xi + U; 0< β1< 1 (Universe)

Where,

Yi is the earnings of individual i,

Xi is the education level of individual i,

β0 is the intercept,

β1 is the Slope coefficient for education level, and

εi is the error term for individual i.

U is the Stochastic or random variable, U = ∑εi

4. Obtaining Information/ Data:

Once the econometric model has been specified, the next step is to collect data that can be used to estimate the model’s parameters. This entails selecting a representative sample of individuals or units from the population of interest. The data should be trustworthy, valid, and pertinent to the research question.

For example, a researcher interested in studying the relationship between education level and earnings could obtain data on a sample of people from the Census Bureau of Statistics.

5. Developing the Econometric Model

After obtaining the data, the next step is to estimate the parameters of the econometric model. This entails estimating the model’s coefficients using statistical techniques. For example, the researcher could use the least squares method to estimate the linear regression model’s coefficients.

We would then estimate the model’s coefficients using statistical techniques such as least squares regression. For example, we might estimate the model as follows:

Yi = 20000 + 5000Xi + εi

Where the intercept is $20,000, the coefficient for education level is $5,000, and εi is the error term.

6. Hypothesis Examination

After estimating the econometric model, the hypothesis or theory is tested. This includes determining whether or not the estimated coefficients are statistically significant and whether or not they support the hypothesis or theory. For example, the researcher could see if the education level coefficient is statistically significant and if it supports the hypothesis that higher levels of education lead to higher earnings.

To test the hypothesis, we would test whether the coefficient for education level is statistically significant using a t-test or a confidence interval.

For example, we might test the hypothesis at a 95% confidence level and find that the coefficient for education level is statistically significant with a p-value of 0.02.

7. Prediction or forecasting

Once tested and validated, the econometric model can be used to make forecasts or predictions. This entails employing the model to forecast the value of the dependent variable for future periods or for individuals or units not included in the original sample. For instance, the researcher could use the model to forecast the earnings of people with varying levels of education.

Once we have estimated the model, we can use it to make predictions about the earnings of individuals with different levels of education. For example, we might predict that an individual with a bachelor’s degree will earn $10,000 more than an individual with only a high school diploma.

8. Modeling for Policy Purposes

Finally, once the econometric model has been estimated and validated, it can be used to inform policy. The model, for example, could be used to assess the impact of policy interventions on the dependent variable. If the model demonstrates that higher levels of education lead to higher earnings, policymakers may be able to use this information to design policies that encourage higher levels of education.

For example, we might use the model to evaluate the impact of a policy that provides subsidies for education. We could estimate the change in earnings resulting from the policy and use that information to recommend it to policymakers.

.jpeg)

0 Comments

If this article has helped you, please leave a comment.